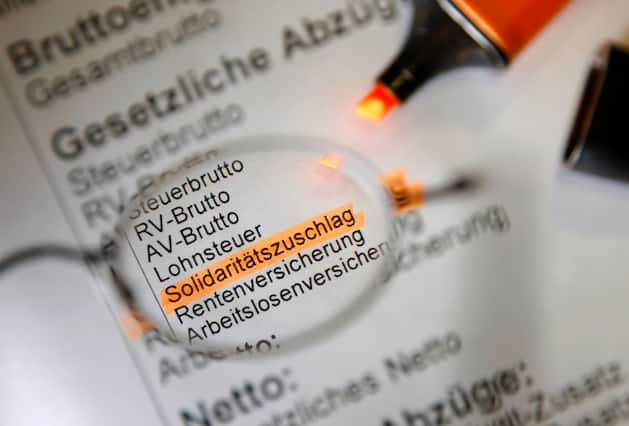

The Federal Fiscal Court has rejected a lawsuit against the “Soli” – rightly so. Instead of wanting to abolish it, you should double it. The difference affects top earners little.

To the great surprise of many observers, the Federal Fiscal Court rejected the lawsuit filed by an Aschaffenburg couple against the solidarity surcharge, declared it legal again and did not refer the case to the Constitutional Court in Karlsruhe.

In the justification of their judgement, the judges stated that the purpose of this supplementary levy – to cover the costs of the unification process – still exists at present, but that it must cease to apply once the “generational task” of German unity has been completed.

Prof. Dr. Christoph Butterwegge taught political science at the University of Cologne from 1998 to 2016 and most recently wrote the book “The polarizing pandemic. Germany after Corona”.

In this context, the President of the Federal Fiscal Court named a period of 30 years, which would mean that the solidarity surcharge (re)introduced in 1995 would expire in the mid-2020s. In addition, the plaintiffs could still file a constitutional complaint with the Federal Constitutional Court, which could previously declare it incompatible with the Basic Law (any longer).

The lawsuit, supported by the taxpayers’ association, assumed that the supplementary levy, affectionately known as “Soli”, may no longer be levied after the Solidarity Pact II expired in 2019 and was redesigned in 2021 because its purpose – financial support for the “development East” – fulfilled and his focus on higher earners is not compatible with the general principle of equality.

In its judgement, the Federal Fiscal Court declared that the federal government’s increased financial requirements to cover the costs associated with unification continued because the creation of equal living conditions in East and West Germany had not yet been completed.

Even the ancient Greek philosophers knew that equals must be treated equally and unequals unequally if justice is to be achieved. The principle of equality laid down in Article 3 of our constitution therefore in no way precludes treating the financially strong and weak differently.

Otherwise, tax progression would also have to be declared illegal – which would certainly put the taxpayers’ association, as a lobbying institution for corporations and top earners, in high spirits!

The polarizing pandemic: Germany after Corona

In this context of argument, there is no need to speak of the wealth tax, which is still part of Article 106 of the Basic Law but has not been levied for over a quarter of a century. However, it proves that the constitutional legislature wanted to involve the rich more in financing state spending.

Nothing else happens with the solidarity surcharge, especially since only ten percent of those subject to income tax and 3.5 percent of those subject to income tax have to pay the full 5.5 percent of the tax liability.

Why does the solidarity surcharge have a similarly high symbolic power for social justice as the wealth tax? Well, because it is the tax policy instrument with the greatest redistribution effect that has existed in this country since the last government under Helmut Kohl frozen the wealth tax in 1997 and the first government under Angela Merkel introduced the withholding tax on capital gains in 2009.

As a result of these two decisions, the state has lost hundreds of billions of euros in revenue on the one hand and precise information about the wealth of its citizens has been withdrawn on the other.

The special charm of the solidarity surcharge is that it is not only levied on wage and income tax (of top earners), but also on capital gains and corporation tax (of investors or companies).

Anyone who demands its abolition, although only top earners and corporations such as GmbHs and AGs have to pay it, while 90 percent of all taxpayers are exempt from it, accepts a further widening of the gap between rich and poor. However, social cohesion dwindles all the more as social inequality increases.

It would be disastrous for the federal budget and scandalous in terms of distribution policy if the solidarity surcharge were abolished. On the one hand, there would be repayment obligations in the high double-digit billion range, which would put an additional burden on the state.

Christian Lindner (FDP) demonstratively did not have the solidarity surcharge defended by top officials of the Federal Ministry of Finance as usual, thereby violating his official duties. When it comes to complying with the “debt brake” in the Basic Law, Lindner always shows his personal responsibility for solid state finances.

On the other hand, if there is an opportunity to financially favor the richest in the country even more than before, the free-democratic saver mutates into a generous spendthrift. Why shouldn’t the income from the solos – probably around 12 billion euros this year – also contribute to budget consolidation in the future?

On the other hand, the inequality in income and wealth that has been growing steadily in Germany since the turn of the millennium would intensify even further. Therefore, the solidarity surcharge should be rededicated, doubled and used to deal with the problems created by the Covid 19 pandemic, the energy (price) crisis and inflation.

The living conditions of millions of people have recently deteriorated drastically because the crisis phenomena were increasing and intensifying. With the pandemic and the first nationwide lockdown, inflationary tendencies set in, which intensified with the Russian war against Ukraine and the Western sanctions in response.

While wealth is hardly affected by this and since then wealth has been concentrated more than ever in the hands of a few (entrepreneurial) families, poverty is now increasing right up to the middle class.

The wider the gap between rich and poor in Germany widens, the more social cohesion dwindles. Because growing inequality is poison for democracy. Due to these dangers, financially strong citizens should not take less, but rather more responsibility for state finances in a crisis situation like the current one.

For singles with a taxable annual income of 100,000 euros, i.e. a gross monthly income of almost 10,000 euros, income tax of 32,027 euros and a solidarity surcharge of 1,723.59 euros will be due in 2023.

If the solidarity surcharge were used and doubled to deal with the climate, pandemic and energy crises, i.e. increased to eleven percent of the income tax liability, the additional burden would amount to just 143.63 euros a month – mind you: with a gross income of around 10,000 euros. Even then, top earners would not have to starve.

In order to attract the wealthy more towards social balance, in addition to raising the wealth tax to which the federal states would be entitled, a special levy for the federal government based on the example of the 1952 burden equalization would be conceivable, for example at a rate of ten percent over five years – i.e. two percent per tax Year.

This would affect net assets worth over one million euros. The other allowances could be designed in the same way as inheritance and gift tax. Then they cheat for spouses 500,000 euros and for each child 400,000 euros.

In the case of a family of four, the wealth tax would be due on the basis of the allowances for a life partner and two children if the net assets were 2.3 million euros or more. Owner-occupied residential property would not be taken into account if its area does not exceed 200 square meters.