Are you ready to witness the spectacular solar eclipse 2024 Texas event that’s capturing the attention of skywatchers across the nation? This once-in-a-lifetime celestial phenomenon promises breathtaking views and unforgettable experiences in the heart of Texas. But did you know there are some amazing facts about this solar eclipse Texas that many people don’t realize? From the science behind the eclipse to the best spots for viewing, we’ve got you covered with insider tips and expert advice. Wondering when and where to catch the perfect moment? Or how to protect your eyes while enjoying the show? Keep reading to discover everything you need to know to make the most of this extraordinary event. The total solar eclipse Texas 2024 will turn day into night, casting a magical shadow that’s both awe-inspiring and mysterious. Don’t miss out on this trending event that’s sparking excitement from Houston to Dallas and beyond. Whether you’re a seasoned astronomer or just curious about this cosmic spectacle, our guide will answer your burning questions and help you prepare for an unforgettable skywatching adventure. Get ready to unlock the secrets of the 2024 solar eclipse Texas and experience the magic firsthand!

Top 7 Must-Know Facts About the Solar Eclipse 2024 in Texas

The much-anticipated solar eclipse of 2024 is causing a buzz all around Texas, especially in Austin where skywatchers are gearing up for an unforgettable celestial show. This rare event is not just a simple darkening of the sun; it’s a cosmic dance that has fascinated humans for centuries. If you live in Texas or planning to visit, you probably want to know what makes this eclipse so special, how to watch it safely, and where you should be to get the best view. Let’s dive into the top 7 must-know facts about the solar eclipse 2024 in Texas, mixed with some practical tips for enjoying this extraordinary phenomenon.

1. What Exactly is a Solar Eclipse and Why 2024 is Special in Texas?

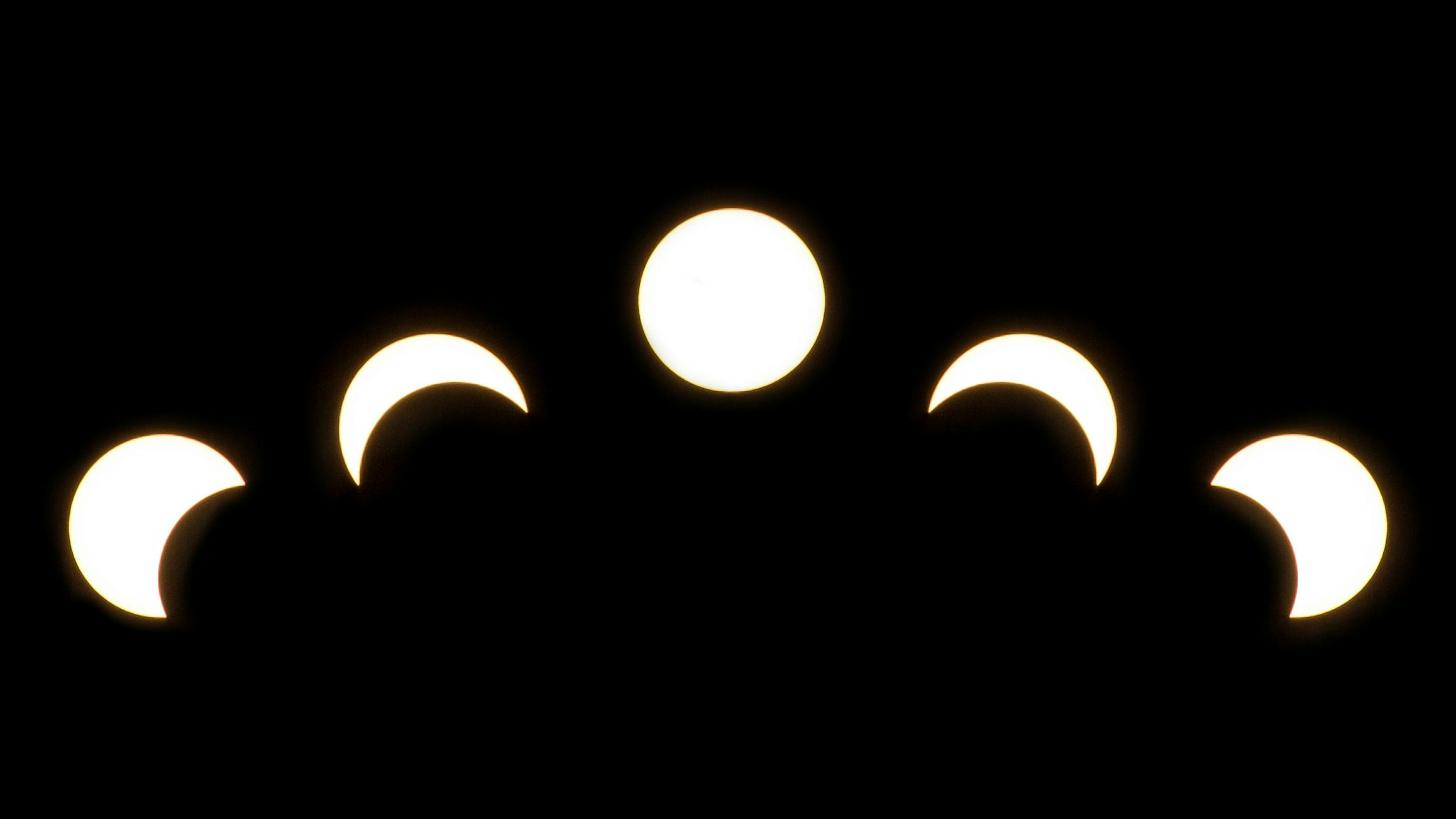

A solar eclipse happens when the moon passes between the Earth and the sun, blocking the sunlight either partially or fully. In 2024, Texas will witness a total solar eclipse, meaning the sun will be completely covered by the moon for a short time. This is super rare and the last time such a total eclipse crossed Texas was in 2017. The 2024 eclipse is special because the path of totality — the area where the total eclipse can be seen — cuts right across the Lone Star State, making it a prime spot for eclipse chasers.

2. The Path of Totality in Texas: Where to Watch?

Not all parts of Texas will experience the total eclipse, but many will see a partial one. The path of totality is a narrow strip about 100 miles wide that will stretch northeast across the state. Cities like Dallas, Austin, and San Antonio are close to or inside the path, but for the best experience, you might want to travel slightly north or east of Austin.

Here’s a simple table showing some notable Texas locations and eclipse visibility:

| Location | Eclipse Type | Duration of Totality (approx) |

|---|---|---|

| Dallas | Total Eclipse | About 4 minutes 10 seconds |

| Austin | Partial Eclipse | Around 2 minutes 30 seconds of partial |

| San Antonio | Partial Eclipse | Around 2 minutes 15 seconds of partial |

| Waco | Total Eclipse | Nearly 4 minutes 20 seconds |

| Texarkana | Total Eclipse | Up to 4 minutes 30 seconds |

3. Historical Context: Why People Care So Much About Eclipses?

Throughout history, solar eclipses have been seen as powerful events. Ancient civilizations like the Maya, Babylonians, and Chinese recorded eclipses with great care, often linking them to important prophecies or rituals. In modern times, scientists use these moments to study the sun’s corona (the outer atmosphere) which is otherwise invisible. The 2024 eclipse will offer researchers opportunities to gather new data, and for everyday people, it’s a chance to witness something truly out of the ordinary.

4. How to Safely Watch the Solar Eclipse in Texas

Looking directly at the sun, even during an eclipse, can cause serious eye damage or blindness. So safety is super important. Here are some tips you should follow:

- Always use certified solar eclipse glasses or viewers.

- Do not use regular sunglasses, smoked glass, or CDs as substitutes.

- Pinhole projectors or solar filters on telescopes/binoculars can be alternative viewing methods.

- When the sun is completely covered (totality), it’s safe to look with your naked eyes — but only during this short period.

- Never look at the sun through an unfiltered camera, telescope, or binoculars.

5. Fun Facts About the 2024 Solar Eclipse in Texas You Might Not Know

- The eclipse will last longer than most, with totality reaching more than 4 minutes in some places — twice as long as the 2017 eclipse.

- Animals may behave strangely during the eclipse, thinking it’s dusk and preparing for night.

- The temperature can drop several degrees during totality, sometimes feeling noticeably cooler.

- Texas will see two eclipses within seven years, with another total solar eclipse expected in 2024 after the one in 2017 — a rare occurrence.

6. Viewing Tips: Best Practices for Enjoying the Eclipse in Austin

If you are in Austin and want to catch the eclipse, here’s a quick list of what you might consider:

- Arrive early at a clear, open location without tall buildings or trees.

- Bring a blanket or chair to relax while waiting.

- Pack snacks and water — the event can last a few hours including partial phases.

- Keep your eclipse glasses handy and wear them whenever the sun is not fully covered.

- Use apps or websites to track the eclipse progress in real-time.

- Avoid driving during totality if possible, as many people will be outside watching.

7. Comparing the 2017 and 2024 Eclipses in

How to Safely View the Solar Eclipse in Texas: Essential Tips and Gear

The much-awaited solar eclipse of 2024 is coming to Texas, and people all over the state are preparing to catch a glimpse of this rare celestial event. But before you rush outside and stare at the sun, it’s very crucial to know how to safely view the solar eclipse in Texas, so you don’t damage your eyes. This article shares some essential tips and gear recommendations, along with amazing facts about the solar eclipse Texas residents should know.

What is the Solar Eclipse 2024 Texas?

A solar eclipse happens when the Moon moves between the Earth and the Sun, blocking the sunlight either partially or completely. In Texas, the 2024 solar eclipse will be a total eclipse in some areas, meaning the sun will be totally covered by the moon for a few minutes. Other parts of Texas will see a partial eclipse, where only a part of the sun is obscured.

This event is particularly special because Texas lies in the path of totality — a narrow track where the total eclipse is visible. Cities like Dallas, Austin, and San Antonio will experience this awe-inspiring moment. The last total solar eclipse visible in Texas was in 2017, so many are excited to witness it again.

Why You Must Never Look Directly at the Sun

Looking directly at the sun without proper protection during an eclipse can cause permanent eye damage, including blindness. The brightness of the sun’s rays is intense even when partially covered by the moon. The retina can burn from the ultraviolet and infrared light.

Some people mistakenly think sunglasses are enough, or that quickly glancing at the sun won’t hurt. Both are wrong. Sunglasses do not block enough of the sun’s harmful rays. Only specially designed solar viewing glasses or indirect viewing methods can protect your eyes.

Essential Gear for Safely Viewing the Solar Eclipse in Texas

To enjoy the solar eclipse 2024 Texas safely, you need the right tools. Below is a list of recommended items:

- Solar Eclipse Glasses: ISO 12312-2 certified glasses block 100% harmful rays.

- Solar Filters for Cameras and Binoculars: Protect your eyes when using devices.

- Pinhole Projector: A DIY way to watch the eclipse indirectly by projecting the sun’s image.

- Solar Viewing Cards: Cards with safe filters similar to eclipse glasses.

- Tripods or Mounts: To steady your camera or binoculars with filters attached.

Avoid using regular sunglasses, smoked glass, CDs, or unverified filters as they can be dangerous.

How to Use Eclipse Glasses Correctly?

It sounds simple but many people misuse eclipse glasses. Here are steps you should follow:

- Put the eclipse glasses on before looking at the sun.

- Do not remove them while still looking at the sun.

- Look away and remove glasses only after you fully look away from the sun.

- Inspect the glasses for scratches or damage before use; damaged glasses are unsafe.

- Never use eclipse glasses with binoculars or telescopes unless combined with a proper solar filter.

Historical Eclipses in Texas: A Quick Look

Texas has seen several notable solar eclipses in the past:

- August 11, 1999: A total eclipse visible in parts of Texas, attracting many skywatchers.

- May 30, 1984: Partial eclipse with about 70% coverage in Texas.

- March 7, 1970: Total eclipse, though visible only in western Texas.

Each eclipse brought excitement but also lessons on safety. The 2017 eclipse was especially memorable because it passed over a major portion of Texas and many gathered to watch with proper equipment.

Practical Tips for Viewing the 2024 Eclipse in Texas

- Check the local timing for your city; the eclipse start and totality times vary across Texas.

- Arrive at your viewing spot early to avoid crowds and get a good place.

- Bring water, sunscreen, and a hat; Texas sun can be strong even in April.

- Use apps or websites that provide live updates and maps of the eclipse path.

- Never look at the sun directly without certified solar glasses.

- Consider attending public viewing events where experts guide you safely.

Solar Eclipse Texas 2024: Interesting Facts

- The eclipse will happen on April 8, 2024, starting in the morning and lasting a few hours.

- The path of totality will stretch from the southwest to the northeast across Texas.

- Totality duration will vary by location; some places will experience more than 4 minutes of total eclipse.

- The next total solar eclipse visible in Texas after 2024 will be in 2045.

- Animals often behave strangely during total eclipses, thinking night has come.

Simple Comparison Table: Solar Eclipse Viewing Methods

| Viewing Method | Safety Level | Notes |

|---|---|---|

| Eclipse Glasses |

When and Where to See the 2024 Solar Eclipse Across Texas: Complete Guide

When and Where to See the 2024 Solar Eclipse Across Texas: Complete Guide

If you live in Texas or planning a trip here in April 2024, you definitely don’t want to miss the spectacular solar eclipse that will cross the Lone Star state. This rare celestial event is getting lots of buzz and for good reasons — it’s a total solar eclipse, meaning the moon will completely block the sun for a short time, turning day into night. But when exactly will it happen and where in Texas should you watch it for the best experience? This guide covers everything you need to know, including some amazing facts and practical tips for eclipse viewing in Texas.

What is a Solar Eclipse and Why 2024 is Special?

A solar eclipse occur when the moon passes directly between the Earth and the sun, casting a shadow on the Earth’s surface. Depending on where you are, you might see a partial eclipse, where the sun is only partially covered, or a total eclipse, where the sun is fully obscured by the moon. The 2024 eclipse is one of the rare total eclipses visible in North America, with a path that crosses Mexico, the United States, and Canada.

In Texas, this eclipse will be especially dramatic because the path of totality — the narrow strip where the total eclipse can be seen — runs right through the heart of the state. This means some cities and towns will experience several minutes of complete darkness during the day, a truly awe-inspiring sight.

When Does the 2024 Solar Eclipse Happen in Texas?

The eclipse will take place on April 8, 2024. The timing varies depending on your location in Texas, but generally, the eclipse will start in the morning and reach totality around midday to early afternoon.

Here is a simplified timeline for some major Texas locations:

| Location | Eclipse Start (Partial) | Totality Begins | Totality Ends | Eclipse Ends (Partial) |

|---|---|---|---|---|

| Dallas | ~11:30 AM | ~12:40 PM | ~12:43 PM | ~1:50 PM |

| Austin | ~11:45 AM | ~1:00 PM | ~1:03 PM | ~2:00 PM |

| San Antonio | ~11:48 AM | ~1:05 PM | ~1:07 PM | ~2:05 PM |

| Amarillo | ~11:15 AM | ~12:25 PM | ~12:28 PM | ~1:30 PM |

| Houston (partial only) | ~11:42 AM | N/A | N/A | ~2:05 PM |

Note: Houston lies just outside the path of totality, so people there will only see a partial eclipse.

Best Places to Watch the 2024 Solar Eclipse in Texas

Because the eclipse’s path of totality is relatively narrow — roughly 115 miles wide — being in the right spot is crucial. Here’s a list of Texas towns and cities where you can see the full eclipse:

- Del Rio: One of the first Texas cities where totality starts; expect about 4 minutes of darkness.

- Kerrville: A popular spot with clear skies and good amenities.

- Fredericksburg: Known for its scenic views and wineries, great for combining eclipse watching with a getaway.

- Lampasas: Small town with great open fields for unobstructed viewing.

- Waco: Larger city on the path, good for those wanting urban conveniences.

- Dallas-Fort Worth area: Northern suburbs will experience totality, but downtown Dallas is just outside, so check exact location carefully.

Amazing Facts About the 2024 Solar Eclipse in Texas

- This will be the first total solar eclipse visible in Texas since 2017 — that’s 7 years ago.

- The total eclipse can last up to 4 minutes and 26 seconds in some parts of Texas, which is longer than many other eclipses.

- During totality, the temperature can drop by several degrees, sometimes making it feel like night.

- Animals often act strangely — birds may stop singing and nocturnal creatures may come out for a bit.

- Solar eclipses have been studied for centuries and helped scientists learn about the sun’s corona (its outer atmosphere).

Tips for Safely Viewing the Solar Eclipse

Looking directly at the sun without protection can seriously damage your eyes. Here’s what you should always remember:

- Use certified eclipse glasses with ISO 12312-2 safety standard.

- Do not use regular sunglasses, even if they are very dark.

- Use a pinhole projector or other indirect viewing methods if you don’t have eclipse glasses.

- Never look through a camera, telescope, or binoculars without a proper solar filter.

- Arrive early to your chosen viewing

Exploring the Science Behind the 2024 Solar Eclipse Visible in Texas

The year 2024 brings a spectacular event that many Texans are looking forward for — the solar eclipse. This astronomical phenomenon will be visible in many parts of Texas, offering a rare chance to witness the sun being obscured by the moon. But what exactly happens during this event, and why it is so special for Texas? Let’s get into the science behind the 2024 solar eclipse Texas will see, share some amazing facts, and offer practical tips for those who want to enjoy the moment safely and memorably.

What is a Solar Eclipse and Why Does It Happen?

A solar eclipse occurs when the moon moves between the Earth and the sun, partially or totally blocking the sunlight reaching Earth’s surface. This can only happen during a new moon phase, when the moon is directly aligned with the sun and Earth. The 2024 eclipse is a total solar eclipse, meaning the moon will completely cover the sun for a short period, turning day into night in some areas.

The moon’s shadow is what causes the eclipse. It has two parts: the umbra and penumbra. The umbra is the dark, central shadow where the sun is fully blocked and people will see the total eclipse. The penumbra is the lighter shadow where only part of the sun is covered, causing a partial eclipse. Texas falls within the path of the umbra, so many cities will experience total darkness briefly.

Why Texas is a Prime Spot for the 2024 Solar Eclipse

Texas is lucky because the path of totality, where the total eclipse can be observed, crosses right through the state. This path runs from the southwestern border near Del Rio, through cities like Austin, Dallas, and up to the northeastern part near Texarkana. This makes Texas one of the best places in the U.S. to see the 2024 eclipse.

Historically, Texas has seen eclipses before, but the 2024 event is unique because of its timing and path. It is the first total eclipse visible in Texas since 2017, and the next one won’t come for many years. The event will last about 4 minutes at the longest spots in Texas, which is longer than many other eclipses.

Amazing Facts About the 2024 Solar Eclipse Texas Will See

- The eclipse will begin on April 8, 2024, and will be visible across North America.

- The path of totality in Texas is about 100 miles wide.

- Cities like Austin will experience total darkness for approximately 4 minutes.

- The moon’s shadow travels at over 1,500 miles per hour.

- Animals often react strangely during the eclipse, behaving as if it were nighttime.

- The eclipse will provide a rare chance for scientists to study the sun’s corona — its outer atmosphere — which is usually invisible.

How to Safely View the Solar Eclipse in Texas

It’s very important to protect your eyes when watching the eclipse. Looking directly at the sun without protection can cause serious eye damage, even blindness. Here are some tips for safe viewing:

- Use certified solar eclipse glasses that meet international safety standards.

- Do NOT use regular sunglasses or homemade filters.

- Avoid looking through cameras, binoculars, or telescopes without proper solar filters.

- During totality (when the sun is fully covered), it’s safe to look directly at the eclipse, but only for the brief period of full coverage.

- Plan to be in a location with a clear view of the sky, away from tall buildings or trees.

- Bring a comfortable chair, water, and snacks to enjoy the event comfortably.

- Arrive early to avoid traffic and secure a good viewing spot.

Comparing the 2024 Eclipse to Previous Eclipses in Texas

| Eclipse Year | Type | Duration of Totality | Path Location in Texas | Notable Facts |

|---|---|---|---|---|

| 2017 | Total | About 2 minutes | Central Texas, including Austin | First total eclipse in U.S. since 1979 |

| 2024 | Total | Up to 4 minutes | From Del Rio to Texarkana | Longer totality duration, wider path |

| 2078 | Partial | N/A | Northern Texas | Partial eclipse only |

The 2024 eclipse stands out because it offers a longer viewing time and covers a larger area in Texas compared to 2017. For many residents, it will be the best eclipse they see in their lifetime.

What to Expect During the Eclipse Day in Texas

On the day of the eclipse, the sky will slowly darken as the moon moves in front of the sun. Temperatures may drop slightly, and shadows may look sharper or distorted. Some people report feeling a strange quiet or stillness during totality. Birds might stop singing and animals could become confused.

The horizon may glow

Best Texas Cities to Experience the Total Solar Eclipse in 2024

The year 2024 is bringing something truly special to Texas skies—a total solar eclipse that will captivate millions. For those living in Austin and surrounding areas, this celestial event is like a once-in-a-lifetime occasions. But where exactly in Texas should you go to get the best view? And what should you know before you look up? Let’s dive into the best Texas cities to experience the total solar eclipse in 2024, along with some fascinating facts and helpful tips for viewing the solar eclipse in Texas.

What is a Total Solar Eclipse?

A total solar eclipse occurs when the moon passes directly between the Earth and the Sun, casting a shadow that fully or partially blocks the sun’s light in certain areas. The 2024 eclipse will be one of the most widely visible in North America in decades, and Texas will be one of the prime spots for watching it. The totality—when the sun is completely obscured—lasts only a few minutes, but it’s a breathtaking sight that turns day into night.

Why Texas? Why 2024?

Texas lies in the path of totality for the April 8, 2024, eclipse. This means several cities in the state will experience the full effect, not just a partial eclipse. The state’s large size and varied geography make it especially interesting for eclipse chasers. From the Hill Country to the Panhandle, Texas offers diverse landscapes to witness this astronomical event.

Best Texas Cities to Experience the Total Solar Eclipse in 2024

Here’s a list of some of the best cities to catch the total eclipse, ranked by duration of totality, accessibility, and local amenities:

| City | Duration of Totality | Notes |

|---|---|---|

| Del Rio | 4 minutes 26 seconds | Close to the Mexican border, warm spring weather |

| Kerrville | 4 minutes 23 seconds | Charming small town, Texas Hill Country vibe |

| Lampasas | 4 minutes 18 seconds | Rural setting, less crowded |

| San Angelo | 4 minutes 15 seconds | Larger city with good accommodations |

| Abilene | 3 minutes 50 seconds | Urban center, many viewing spots |

| Wichita Falls | 3 minutes 45 seconds | Northern Texas, good transportation links |

If you’re living in Austin, it’s about a two-hour drive to Kerrville, which is perfect for a day trip. Kerrville and Del Rio are especially popular because they offer longer totality durations plus comfortable weather in April.

Amazing Facts About the 2024 Solar Eclipse in Texas

- The 2024 eclipse path stretches from Mexico through Texas and up to the northeastern United States.

- This will be the first total solar eclipse visible in Austin since 1979, but Austin itself will see only a partial eclipse.

- Totality in Texas will last between approximately 3 minutes 40 seconds and over 4 minutes—longer than many past eclipses.

- The eclipse happens during the afternoon, starting around 12:30 PM local time in Texas and reaching totality around 1:30-1:40 PM.

- The next total solar eclipse visible in Texas won’t happen until 2045.

Solar Eclipse Texas: Discover Viewing Tips

Watching an eclipse is exciting but it requires some preparation to be safe and get the best experience.

- Never look directly at the sun without proper eye protection. Regular sunglasses do NOT protect your eyes from solar rays.

- Use certified solar viewing glasses or a solar filter with binoculars or cameras.

- Plan to arrive early at your viewing spot. Popular locations will get crowded.

- Bring a blanket or chair for comfort.

- Check the weather forecast. Clouds can ruin the view.

- If you miss the totality, partial phases last longer so you still get to see the moon’s shadow moving across the sun.

- Don’t forget your camera but avoid looking through the camera lens without solar filters.

Comparing Viewing Experiences: Texas vs Other States

Texas offers some unique benefits compared to other states in the eclipse path:

- Longer totality time: Texas cities near the southern edge of the path get more minutes of total darkness.

- Warmer spring climate: April weather in Texas tends to be mild and clear, unlike northern states that might be cold or rainy.

- Accessibility: Texas has many highways and airports close to eclipse towns.

- Diverse landscapes: From deserts to hills and rivers, Texas scenery adds to the eclipse experience.

Practical Examples of Eclipse Viewing in Texas

Imagine setting up your viewing spot in a quiet park in Kerrville. You arrive around noon, with eclipse glasses in hand, and the sky is crystal clear. The moon starts to creep in front of the sun, turning daylight dimmer and dimmer. Birds quiet down, and a chilly breeze picks up. Then, for about 4 minutes, the sun disappears completely

What Makes the 2024 Solar Eclipse in Texas a Once-in-a-Lifetime Event?

There’s something truly magical about a solar eclipse, and the 2024 solar eclipse in Texas is shaping up to be an unforgettable experience for residents and visitors alike. This rare astronomical event is more than just a celestial show; it’s a moment that connects us to the universe in a way few other natural phenomena can. But what makes the 2024 solar eclipse in Texas a once-in-a-lifetime event? Let’s explore some amazing facts, historical insights, and practical tips to help you enjoy this spectacular occurrence.

Why the 2024 Solar Eclipse in Texas is So Special

First off, the 2024 solar eclipse is a total solar eclipse, where the moon completely blocks the sun for a brief period. This event is rare because total eclipses only happens about every 18 months somewhere on Earth, but for Texas, the path of totality—where you can see the total eclipse—will pass right through the state. This means many people in Texas will get to witness the sun totally disappearing, turning day into night for a few minutes.

Texas is one of the few places in the U.S. that will get such a clear view of the eclipse. The path of totality stretches from the southwestern border near Del Rio, through Austin, and then up northeast toward Dallas and beyond. Many cities along the path will experience over four minutes of total darkness, which is unusually long for an eclipse.

Historical Context: Eclipses in Texas

Eclipses have fascinated humans for thousands of years, and Texas has seen its share of these events. However, the last time a total solar eclipse crossed Texas in such a direct path was back in 2017. That eclipse drew huge crowds and sparked a surge of public interest in astronomy. The 2024 eclipse is expected to be even more dramatic because it will travel a different route, covering some areas that missed the 2017 event.

Here’s a quick look at some key historical solar eclipses visible in Texas:

- 2017: Total solar eclipse visible in central Texas, lasting up to 2 minutes 40 seconds.

- 2024: Total solar eclipse with up to 4 minutes 28 seconds of totality in some parts of Texas.

- Next notable eclipse in Texas won’t be until 2045, making 2024 quite the rare opportunity.

Amazing Facts About the 2024 Solar Eclipse

- The moon’s shadow will move across Texas at about 1,500 miles per hour.

- Totality will last longer than usual — some locations get more than 4 minutes, which is considered very long.

- The eclipse will cause temperatures to drop noticeably, sometimes by as much as 15 degrees Fahrenheit.

- Animals may behave strangely; birds might stop singing, and nocturnal creatures could become active.

- The next total solar eclipse crossing Texas’ path won’t happen for over 20 years, so missing this one means waiting a long time.

Solar Eclipse 2024 Texas: Best Viewing Tips

Watching a solar eclipse safely is super important. Looking directly at the sun without protection can seriously hurt your eyes. Here’s what you should keep in mind:

- Use Proper Eclipse Glasses: Regular sunglasses aren’t enough. Make sure your eclipse glasses meet the ISO 12312-2 safety standard.

- Don’t Use Damaged Glasses: Inspect your glasses for scratches or holes before use.

- Pinhole Projectors Are Fun: You can make a simple pinhole projector with cardboard to watch the eclipse indirectly.

- Arrive Early: Popular viewing spots in Texas, like Austin’s parks or Hill Country, will be crowded. Get there early to secure a good spot.

- Bring Supplies: Water, snacks, hats, and sunscreen are a must, especially in Texas’ sunny spring weather.

- Check the Weather: Clouds can block your view, so keep an eye on local forecasts.

- Don’t Forget Your Camera: But remember, don’t look through your camera or phone lens without a solar filter.

Comparing the 2017 and 2024 Solar Eclipses in Texas

| Feature | 2017 Eclipse | 2024 Eclipse |

|---|---|---|

| Path Through Texas | Central Texas | Southwest to Northeast Texas |

| Maximum Totality Duration | About 2 minutes 40 seconds | Up to 4 minutes 28 seconds |

| Cities in Path | Austin, San Antonio | Austin, Dallas, Del Rio |

| Frequency in Texas | Rare (once in a few decades) | Even rarer with longer totality |

| Public Interest Level | Very high | Expected to be even higher |

What to Expect During the Eclipse

During the peak of the eclipse, the sky will darken as if it’s nighttime. The sun

Step-by-Step Guide to Photographing the Solar Eclipse 2024 in Texas

The solar eclipse of 2024 is one of the rarest and most exciting celestial event that Texas residents and visitors will witness in a long time. This event will not just light up the skies but also offer a unique chance for photographers and skywatchers to capture something truly out of this world. If you are living in Austin or anywhere in Texas, and wondering how to photograph this spectacular phenomenon, you’ve come to the right place. This guide will walk through the basics, share interesting facts, and offer practical tips so you don’t miss out on the solar eclipse 2024 in Texas.

What Is the Solar Eclipse 2024 in Texas?

A solar eclipse happens when the Moon moves between the Earth and the Sun, blocking some or all of the Sun’s light. The 2024 solar eclipse is a total eclipse visible in parts of Texas, meaning the Moon will completely cover the Sun for a brief period. This event is expected to take place on April 8, 2024. Cities like Austin will experience a partial eclipse, while areas north and west of Austin will see a full total eclipse.

Solar eclipses are not everyday occurrence; total eclipses at any given location happen roughly every 375 years on average! So this is a once-in-a-lifetime opportunity for many Texans.

Amazing Facts About the Solar Eclipse in Texas

- The 2024 eclipse path stretches from Mexico, across Texas, then through parts of the Midwest and Northeast US, finally ending in Canada.

- Texas will be one of the best places to see the total eclipse because the path of totality crosses near cities such as Dallas and Austin.

- During totality, the sky turns dark as if it is nighttime, stars become visible, and the solar corona (the Sun’s outer atmosphere) glows around the Moon.

- The last total solar eclipse visible in Texas was in 2017, so this event comes after a 7-year wait.

- Observers outside the path of totality will only see a partial eclipse, where the Moon covers part of the Sun.

- Never look directly at the Sun without proper eye protection, even during an eclipse, as it can cause permanent eye damage.

Step-by-Step Guide to Photographing the Solar Eclipse 2024 in Texas

Taking photos of an eclipse is not just point and shoot; it needs preparation and special equipment. Here is a simple outline to help you get ready:

Research Your Location and Timing

- Check the exact time the eclipse will begin, peak, and end for your city in Texas.

- Decide where you want to set up your camera; higher ground with a clear view of the sky is best.

- Arrive at your spot early to avoid crowds and find a good composition.

Get the Right Equipment

- Camera with manual settings (DSLR or mirrorless preferred).

- Telephoto lens (at least 200mm) to zoom in on the Sun.

- Solar filter specifically designed for cameras to protect your lens and sensor.

- Tripod to keep your camera steady.

- Remote shutter release or timer to reduce shake.

Practice Before the Eclipse Day

- Try photographing the Sun on a normal day using your solar filter.

- Experiment with different shutter speeds and apertures.

- Understand how to quickly adjust settings as the eclipse progresses.

During the Eclipse

- Start shooting when the Moon begins to cover the Sun (partial phase).

- Use shorter exposures to capture the bright Sun safely.

- Remove the solar filter only during the totality phase to photograph the corona.

- Be ready to put the filter back on as soon as totality ends.

- Take multiple shots at different exposures for variety.

Post-Processing

- Use photo editing software to adjust contrast and bring out corona details.

- Combine multiple images to create a composite showing phases of the eclipse.

Viewing Tips for Solar Eclipse 2024 in Texas

- Always use certified solar eclipse glasses; regular sunglasses are NOT safe.

- Don’t look at the Sun through cameras, binoculars, or telescopes without solar filters.

- Protect your skin with sunscreen if you plan to watch for long periods.

- Bring water, snacks, and a comfortable chair or blanket.

- Check weather forecasts as clouds can ruin the view.

- Join local events or astronomy clubs to learn and share the experience.

Quick Comparison: 2017 vs 2024 Solar Eclipse in Texas

| Feature | 2017 Eclipse | 2024 Eclipse |

|---|---|---|

| Date | August 21, 2017 | April 8, 2024 |

| Path of Totality | Crossed central Texas | Crosses northern and central Texas |

| Duration of Totality | About 2 minutes at max |

How to Prepare Your Family for the Solar Eclipse 2024 Viewing in Texas

The much-anticipated solar eclipse of 2024 is fast approaching, and Texas is one of the prime spots to witness this awe-inspiring celestial event. Many families in Austin and across the state are getting excited but also wondering how to best prepare for the day. Watching a solar eclipse is not something you do every year, so a little planning goes a long way to make sure everyone enjoys the experience safely and memorably.

Why Texas is a Great Place for the Solar Eclipse 2024

Texas lies directly in the path of totality for the 2024 eclipse, meaning parts of the state will see the moon completely cover the sun for several minutes. Cities like Austin, Dallas, and San Antonio will have some awesome viewing opportunities. This is a bit different from the 2017 eclipse, where only a small portion of Texas was in the path of totality.

Historically, solar eclipses have fascinated humans for thousands of years. Ancient cultures often thought they were omens or messages from the gods. Today, we understand the science behind it, but the wonder remains. The 2024 eclipse will begin on April 8th and will last a few hours from start to finish, with the total eclipse phase lasting just a few minutes depending on your exact location.

Amazing Facts about the Solar Eclipse Texas is Getting Ready for

- The 2024 eclipse will be one of the longest total solar eclipses in the 21st century, with totality lasting up to 4 minutes and 28 seconds in some parts of Texas.

- The path of totality crosses over 10 states, but Texas is one of the largest areas where you can see the full effect.

- Unlike the 2017 eclipse, which happened in late summer, this eclipse is in early April—sometimes weather can be unpredictable, which makes preparation important.

- During totality, the sky becomes dark enough to see stars and planets, and the temperature can drop several degrees.

How to Prepare Your Family for the Solar Eclipse Viewing in Texas

Viewing a solar eclipse is exciting but also requires caution and preparation. Here’s how you can get ready with your family:

Get Proper Eye Protection

Looking directly at the sun during an eclipse without protection can cause serious eye damage. Make sure you have ISO-certified eclipse glasses for everyone. Sunglasses are not enough!- Buy eclipse glasses early, as they might sell out quickly.

- Check for certification marks and avoid cheap knock-offs.

Pick the Right Viewing Spot

Find a location in the path of totality if you want to see the full eclipse. Some parks or open areas outside city lights are ideal.- Avoid looking at the sun through cameras, telescopes, or binoculars without special filters.

- Arrive early to avoid parking headaches.

Prepare for Weather and Comfort

April weather in Texas can be unpredictable. Bring blankets, chairs, sunscreen, water, and snacks.- Dress in layers to adjust to temperature changes.

- Have a backup plan in case of rain or heavy clouds.

Educate Your Kids

Talk to your children about what will happen during an eclipse so they know what to expect. Use fun facts and stories to keep them engaged.- Explain why looking at the sun is dangerous.

- Use apps or books to show what the eclipse will look like.

Plan for Traffic and Crowds

Popular eclipse spots may become crowded and cause traffic jams.- Leave early and consider carpooling.

- Bring entertainment for waiting times.

Comparison: Solar Eclipse 2017 vs Solar Eclipse 2024 in Texas

| Feature | 2017 Eclipse | 2024 Eclipse |

|---|---|---|

| Date | August 21, 2017 | April 8, 2024 |

| Path of Totality in Texas | Limited to western Texas | Covers large central & eastern Texas |

| Duration of Totality | Up to 2 minutes 40 seconds | Up to 4 minutes 28 seconds |

| Weather Considerations | Summer heat and clear skies mostly | Early spring, possible rain or clouds |

| Public Awareness | Huge national event, many prepared | Growing awareness, but less hype yet |

Tips for Viewing the Solar Eclipse with Kids in Texas

- Make it a mini field trip: Pack a picnic, bring binoculars (with solar filters), and have fun exploring nature before and after the eclipse.

- Use pinhole projectors: Teach kids how to make simple pinhole viewers using cardboard or a shoebox to watch the eclipse safely.

- Turn it into a science lesson: Explain the sun, moon, and Earth’s alignment with simple diagrams or apps.

- Capture memories: Bring a

Top 5 Myths and Facts About the Solar Eclipse 2024 in Texas Explained

The much-anticipated solar eclipse of 2024 is fast approaching, and Texas is one of the prime locations to witness this spectacular celestial event. Many people in Austin and across the state are buzzing with excitement, but there are also lots of myths and misinformation floating around about what will happen and how to safely enjoy it. Whether you’re a first-time eclipse watcher or a seasoned sky gazer, understanding the truth behind these common myths can make your experience better and safer.

Top 5 Myths and Facts About the Solar Eclipse 2024 in Texas Explained

Myth: It’s Dangerous to Look at the Eclipse Even with Glasses

Fact: You must use proper solar eclipse glasses to view the eclipse safely. Regular sunglasses don’t provide enough protection. Looking directly at the sun without the correct eyewear can cause serious eye damage. The eclipse glasses block out harmful ultraviolet, infrared, and intense visible light. Remember, never look at the sun through cameras, binoculars, or telescopes without special filters designed for solar viewing.Myth: The Eclipse Will Last for Hours

Fact: The total phase of the eclipse, when the sun is completely covered by the moon, lasts only a few minutes. In Texas, the totality duration varies by location but generally ranges from about 3 to 4 minutes. The entire event, including partial phases before and after, may take a few hours, but the breathtaking moment of total darkness is brief.Myth: Eclipses Are Rare and Unpredictable

Fact: While total solar eclipses in any one spot are rare, eclipses themselves happen about every 18 months somewhere on Earth. What’s special about 2024’s eclipse is its path crosses a wide swath of the US, including Texas, giving millions of people a chance to see it. Astronomers have been predicting eclipses for centuries with great accuracy.Myth: Animals Will Behave Strangely and Plants Will Die

Fact: Animals might become confused or change their behavior temporarily during the eclipse, but there’s no evidence that it causes lasting harm. Plants won’t die because of a few minutes of darkness. Instead, some flowers might close up like they do at night, and birds might stop singing briefly.Myth: You Don’t Need to Prepare; Just Look Up and Enjoy

Fact: Preparation is key to a safe and enjoyable eclipse experience. Buying certified eclipse glasses ahead of time, knowing the exact timing for your location, and picking a good viewing spot away from city lights make a big difference. Also, it’s smart to bring water, snacks, and maybe a camera or binoculars (with solar filters) to enhance your experience.

Solar Eclipse Texas: Discover Amazing Facts and Viewing Tips

The 2024 solar eclipse is special for Texas because the path of totality — the narrow band where the sun is completely covered by the moon — will cross through the state from west to east. Cities like Austin, Dallas, and San Antonio will experience a partial eclipse, but if you travel a bit north or west, you can see the full totality.

Some amazing facts about this eclipse in Texas include:

- Duration of Totality: Up to 4 minutes and 28 seconds in some places, which is longer than the last major eclipse in 2017.

- Path Width: Approximately 115 miles wide, so there’s a good chance to find a spot within the totality zone without too much hassle.

- Historical Context: Texas last saw a total solar eclipse in 2017, but the 2024 eclipse will be the first one crossing more of the state’s central and northeastern regions in over a century.

Viewing Tips for the Solar Eclipse 2024 in Texas

To make the most out of this rare experience, here’s a practical checklist:

- Get certified solar eclipse glasses early — they sell out fast!

- Check the local eclipse timing for your city or town.

- Find a viewing spot away from tall buildings and trees for a clear sky.

- Bring a blanket or folding chair for comfort.

- Pack water and snacks; you might be outside for a couple hours.

- Avoid using regular cameras, phones, or binoculars directly pointed at the sun without solar filters.

- Plan for traffic — many people will travel, so leave early.

- Learn what phases of the eclipse you’ll see at your location (partial or total).

Quick Comparison: 2017 vs 2024 Solar Eclipses in Texas

| Feature | 2017 Eclipse | 2024 Eclipse |

|---|---|---|

| Path Across Texas | South to North | West to East |

| Duration of Totality | Up to 2 minutes 40 seconds | Up to 4 minutes 28 seconds |

Solar Eclipse 2024 Texas: Unlocking the Secrets of This Spectacular Celestial Event

The Solar Eclipse 2024 Texas is one of the most anticipated celestial events in recent memory. People all over the state, from Austin to Dallas and beyond, are preparing to witness this spectacular show in the sky. If you never seen a solar eclipse before, this upcoming event offers a unique chance to experience something truly awe-inspiring and mysterious. The sky will darken, birds might stop singing, and the sun will seem to disappear, leaving behind a glowing halo. But what really happens during a solar eclipse? And how can Texans best enjoy this moment? Let’s dive into the amazing facts and practical tips about the solar eclipse in Texas 2024.

What is a Solar Eclipse?

Simply put, a solar eclipse happens when the moon moves between the Earth and the sun, blocking the sunlight either partially or fully. This alignment causes the sun to look like it’s covered by a dark shadow. There are mainly three types of solar eclipses:

- Partial Eclipse: Only part of the sun is covered by the moon.

- Total Eclipse: The moon completely cover the sun for a short period.

- Annular Eclipse: The moon is farthest from Earth, so it looks smaller and creates a “ring of fire” around it.

The 2024 event in Texas will be a total solar eclipse, which is pretty rare and exciting.

Why Texas is a Prime Spot for the 2024 Eclipse?

Texas lies right in the path of totality for the April 8, 2024 eclipse, meaning people there will see the sun fully covered by the moon. The path of totality is a narrow band, around 100 miles wide, where the total eclipse can be observed. Cities like Austin, Dallas, and San Antonio will experience this full darkness, but time and duration varies depending on location.

Texas will witness about 4 minutes of totality in places close to the center of the path. That’s longer than many other parts of the U.S., making it a prime viewing area. The weather in spring is also usually pleasant, which increase the chance that skies will be clear.

Historical Eclipses in Texas and Their Impact

Texas has seen several eclipses before, but total solar eclipses are especially memorable. The last total eclipse visible in Texas was in 2017, which drew huge crowds and caused traffic jams on highways as people traveled to the path of totality. Scientists used that event to study the sun’s corona and improve understanding of solar activity.

Historically, eclipses have been regarded as omens or divine messages in many cultures. Native American tribes in Texas had stories and rituals connected to eclipses, interpreting the darkening sky as a powerful sign. Today, we know it’s a natural phenomenon but it still inspires awe and curiosity.

Amazing Facts About the 2024 Solar Eclipse in Texas

- The eclipse will start in the Pacific Ocean, move across Mexico, then Texas, and continue northeast across the United States.

- The total eclipse in Texas will last between 3 to 4 minutes depending on how close you are to the center line.

- The moon’s shadow will move at over 1,500 miles per hour across the state.

- This will be the last total solar eclipse visible in Texas until 2045, making it a once-in-a-generation event.

- Animals often behave strangely during an eclipse; some birds stop singing while nocturnal creatures might become active.

How to Safely View the Solar Eclipse in Texas

Watching a solar eclipse is incredible but dangerous without the right precautions. Looking directly at the sun can cause serious eye damage or blindness. Here are some tips for safely experiencing the eclipse:

- Always use special eclipse glasses that meet the ISO 12312-2 safety standard.

- Do not use regular sunglasses, even very dark ones—they don’t protect your eyes enough.

- Use a pinhole projector or other indirect viewing methods if you want to avoid looking directly at the sun.

- Avoid using cameras, phones, or binoculars without proper solar filters.

- Plan to arrive early to your viewing spot, since popular places fill up fast.

- Check the local weather forecast and have backup locations in case of clouds.

Comparing the 2024 Eclipse with Past Eclipses

| Feature | 2017 Texas Eclipse | 2024 Texas Eclipse |

|---|---|---|

| Type | Total Solar Eclipse | Total Solar Eclipse |

| Duration of Totality | Around 2 minutes | Up to 4 minutes |

| Path Width | Approximately 70 miles | Approximately 100 miles |

| Major Cities in Path | Austin, Dallas, San Antonio | Austin, Dallas, San Antonio |

| Weather Conditions | Early August (hot, humid) | Early April (springtime) |

| Next Similar Event | 2017 | 2024 |

Conclusion

The 2024 solar eclipse in Texas promises to be a spectacular celestial event, offering residents and visitors a rare opportunity to witness nature’s grandeur. From the path of totality crossing iconic cities like Dallas, Austin, and San Antonio to the optimal viewing spots scattered across the state, the eclipse is set to captivate millions. Preparation is key—ensuring you have proper eye protection, arriving early at prime locations, and understanding the timing will enhance the experience. Beyond the awe-inspiring visuals, the eclipse also serves as a reminder of our connection to the cosmos and the importance of scientific exploration. Whether you’re a seasoned astronomy enthusiast or a curious newcomer, this event is not to be missed. Mark your calendars, gather your eclipse glasses, and join the excitement as Texas becomes the epicenter of one of nature’s most extraordinary phenomena in 2024. Don’t miss out on a truly unforgettable experience!