Imagine a world where the immaculate grid revolutionizes how we experience energy consumption. Are you curious about how this cutting-edge concept can transform our daily lives? The immaculate grid refers to a perfectly organized energy system that connects renewable resources, smart technology, and efficient distribution networks. Why is this important? As we face escalating climate change issues, the need for sustainable energy solutions has never been more crucial. In fact, experts predict that by 2030, more than 50% of the global energy supply will come from renewable sources. But what does this mean for you? The integration of the immaculate grid could lead to lower energy bills and a reduced carbon footprint. Picture a future where your home automatically adjusts its energy usage based on real-time data, optimizing efficiency and minimizing waste. Could this be the key to a sustainable future? Join us as we delve deeper into the intricacies of the immaculate grid, exploring its potential impacts on urban living, technological advancements, and the evolution of smart cities. Discover how embracing this innovative approach can pave the way for a cleaner, greener tomorrow. Are you ready to embrace the future of energy?

Unlocking the Immaculate Grid: 10 Proven Strategies for Flawless Organization in Your Life

Have you ever heard of the term immacualte grid? Not really sure why this matters, but it’s one of those concepts that makes you go “huh, that’s interesting.” It’s like when you find a sock that’s been missing for ages. You’re not quite sure how it got there, but there it is, just hanging out, making your day a little brighter. So, let’s dive into this concept and see what we can dig up.

First things first, the immacualte grid is a design principle that’s used in various fields, from architecture to graphic design. It’s like the perfect recipe for your favorite dish, but instead of food, you’re cooking up layouts and structures. The idea is to create a layout that’s so clean and organized that it’s almost like it was made by a computer. But, let’s be real, who actually wants that? Life is messy, right? So why should our designs be any different?

Now, if you’re thinking of applying the immacualte grid in your work, here’s a handy table to guide you through the process:

| Step | Description | Tips and Tricks |

|---|---|---|

| 1. Define | Pinpoint what you want to achieve with your grid. | Maybe it’s just me, but setting clear goals helps a lot. |

| 2. Research | Look into existing grids that inspire you. | Pinterest is your best friend here! |

| 3. Create | Start sketching out your grid. | Don’t stress about it being perfect. |

| 4. Refine | Tweak the design until it feels right. | Sometimes you gotta break a few rules, ya know? |

| 5. Implement | Put your grid into action. | Test it out and see how it goes! |

Okay, so now you’ve got your grid laid out. But here’s the kicker: even with an immacualte grid, it’s super easy to fall into the trap of making things too sterile. Like, nobody wants to live in a museum, right? So, how do we find the balance? Maybe it’s about adding a splash of color or a quirky element that just makes people go “whoa.”

Speaking of quirky, let’s talk about the use of whitespace. It’s like the unsung hero of design. Without it, your immacualte grid could end up looking like a cluttered junkyard. Too much stuff can confuse the viewer, and we don’t want that. A good rule of thumb is to think of whitespace as the breathing room. It’s like taking a deep breath before diving into the chaos of life.

Now, if you’re creating something for a client, they might want everything to be “perfect.” But tell me, who even defines perfect? It’s subjective, like the taste of pineapple on pizza. Some people love it, and others are totally grossed out. So, maybe when you present your immacualte grid, you should throw in a couple of messy elements. Just to keep things interesting, you know?

Here’s a quick list of elements you might consider adding to your grid to spice things up:

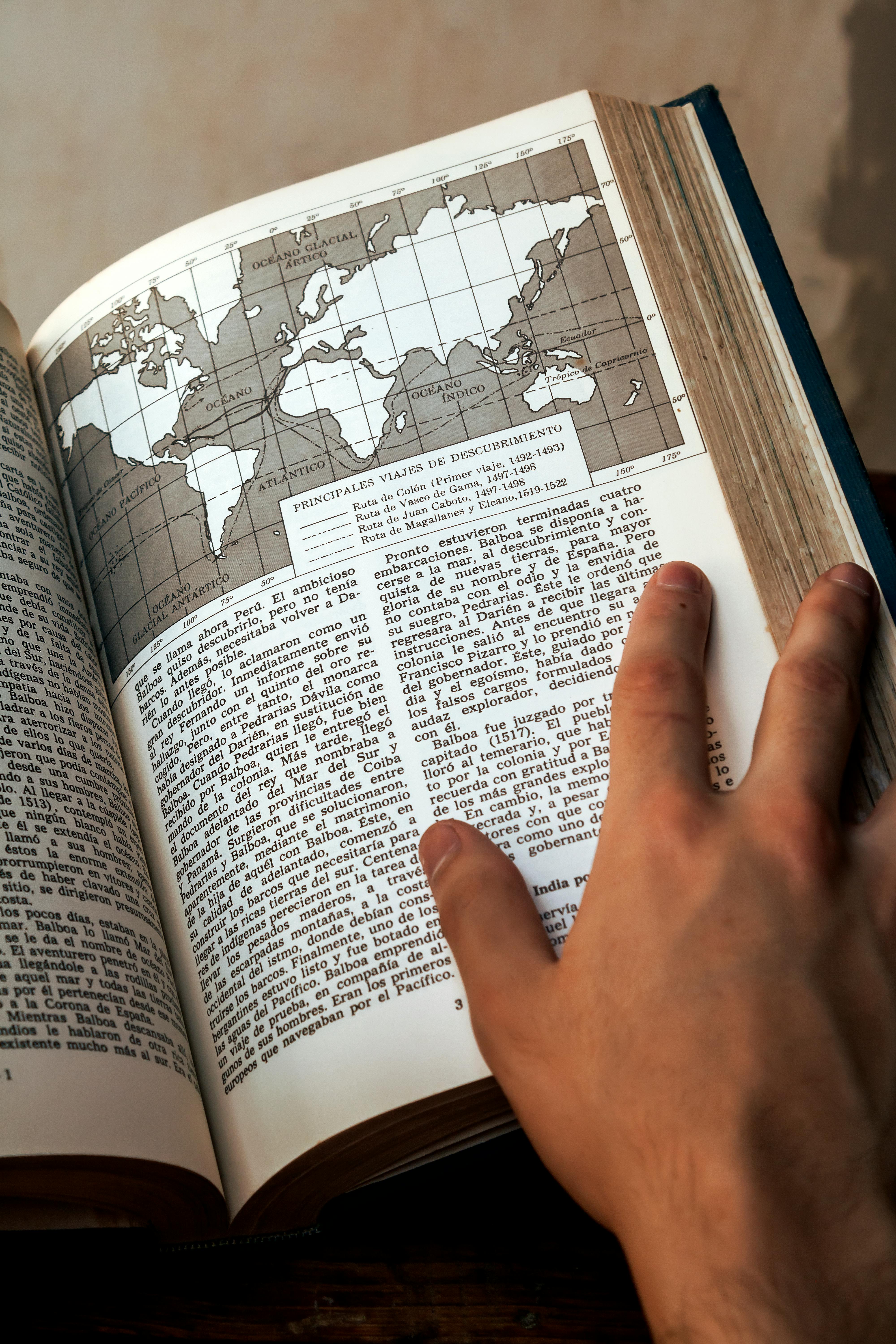

- Textures: A little bit of roughness can go a long way.

- Images: Because who doesn’t love a good visual?

- Fonts: Mix and match to keep it lively.

- Colors: Use a palette that resonates with the vibe you’re going for.

Now, let’s take a moment to ponder the idea of scalability. When you’re working with an immacualte grid, it’s important to think about how it’ll look on different devices. You don’t want your beautiful grid to turn into a jumbled mess when viewed on a phone, right? So, keeping flexibility in mind can save you from some serious headaches down the road.

Oh, and let’s not forget about the feedback. Sometimes, you might think you’ve nailed it, but then someone comes along and points out something you totally missed. It’s like when you think you’re looking fly, but your friend gently reminds you that you’ve got spinach stuck in your teeth. So, getting a second set of eyes on your immacualte grid can help you catch those oops moments before it’s too late.

In the end, whether you’re a seasoned designer or just dabbling in the world of layout, remember that the immacualte grid is a tool, not a rule. Use it to your advantage, but don’t be afraid to step outside the lines now and again. After all, life’s too short to be boxed in by perfection. Embrace the chaos, throw in some whimsy, and watch your designs come

The Ultimate Guide to Mastering the Immaculate Grid: 7 Key Principles for Unrivaled Efficiency

So, let’s talk about this whole concept of the immacualte grid. I mean, to be honest, not really sure why this matters, but it’s kinda like the holy grail of organization, right? It’s a system, a layout, or however you wanna call it, that promises to bring order to chaos. And who doesn’t want that? But do we really need another way to line up our stuff? I mean, maybe it’s just me, but it feels like sometimes we’re just trying too hard to make everything look perfect.

Speaking of perfection, the immacualte grid is all about aligning your content, whether it’s on a webpage, poster, or even your kitchen counter. It’s like, “hey, let’s make everything look neat and tidy!” But the truth is, life’s messy. Have you ever tried to get kids to clean up? Yeah, good luck with that! But I digress.

Now, when it comes to using the immacualte grid, you gotta think about the spacing. Like, too much space between elements can make it feel sparse, while too little? Total chaos! It’s like that one friend who just doesn’t know when to stop talking. You know, the one who’s always there, crowding the conversation like they own the place.

Here’s a little breakdown, I guess, of what makes the immacualte grid tick:

- Modular Structure: This means you can divide your layout into smaller sections. It’s like creating little boxes of happiness, or, you know, just sections for your content.

- Consistency: So yeah, keeping things uniform is key. You don’t wanna have one box that’s all big and fancy, while the next one looks like it just rolled outta bed.

- Alignment: This is crucial. Everything needs to line up nice and neat. It’s like having that one friend who always shows up on time, and then there’s the other one who thinks “fashionably late” is a thing.

Now, here’s the kicker: while the immacualte grid looks great in theory, in practice? It can be a real pain in the butt. I mean, have you ever tried to align images perfectly? It’s like wrestling with an octopus! You think you’ve got it, and then BAM! It’s all outta whack again.

Let’s not forget about color theory. Oh boy, the immacualte grid can really take a beating when the colors clash. You ever seen a neon green next to a bright pink? Yeah, not a good look. I mean, maybe it’s just me, but my eyes are screaming for mercy.

Here’s a handy little table that might help you navigate the world of the immacualte grid:

| Element | Importance | Common Mistakes |

|---|---|---|

| Structure | Keeps content tidy | Overcomplicating the layout |

| Consistency | Builds recognition | Using too many fonts/colors |

| Alignment | Guides the eye | Misaligning elements |

| Color | Sets the mood | Clashing colors |

Now, you might be wondering, how do I even start with this immacualte grid thing? Well, grab a pencil, paper, or even some fancy software. Sketch out your ideas, but don’t overthink it. Seriously, you can spend hours trying to perfect something that’s gonna change in a week anyway.

Another thing is, you gotta test it out! Like, put your design out there and see what sticks. People might love it, or they might say it looks like a toddler’s art project. Either way, you’ll learn something. It’s like, you can’t just throw spaghetti at the wall and expect it to stick, right?

And hey, if you’re feeling fancy, try using grids in your social media posts. It’s a great way to keep your feed looking sharp, but don’t go overboard, or it’ll scream “I’m trying too hard!” Maybe sprinkle in some randomness to mix things up.

In the end, the immacualte grid is a tool. Just like any other tool, it can be useful but also a bit of a headache. So, go ahead and embrace the chaos a little. Life is messy, and that’s okay! Maybe it’s just me, but I think a little imperfection makes things more interesting. So, get out there and make your own messy, beautiful grid!

Curious About the Immaculate Grid? Here’s How It Can Revolutionize Your Daily Routine!

Alright, let’s dive into the messy world of the immacualte grid. Now, if you’re thinking, “What even is that?” you’re not alone. I mean, it’s not like we’re all running around shouting about grids, right? But honestly, it’s kinda important for organizing our chaotic lives, or at least that’s what the experts say.

First off, picture this: a perfect grid, all neat and tidy, everything in its right place. Sounds dreamy, huh? But then reality hits. You’ve got your to-do list, your grocery list, and maybe even a list of lists that you need to make. Can you say “overwhelmed”? I think we can all agree that an immacualte grid is like the unicorn of organization—great in theory, but in practice? Not so much.

So, let’s break down the components of this mythical immacualte grid. You’ve got your rows and columns, of course. But, hold up! What if your rows don’t align with your columns? You could end up with a hot mess, which is exactly what happens when life throws a curveball. I mean, I can’t really be the only one who spends two hours organizing their closet only to find out they’ve accidentally shoved their winter coats in the summer section, right?

Here’s a fun little table to illustrate how a grid might look when it’s actually kinda working:

| Task | Priority Level | Status |

|---|---|---|

| Grocery List | High | Incomplete |

| Laundry | Medium | Ongoing |

| Netflix Binge | Low | Complete |

| Organize Desk | Medium | Not Started |

Now, maybe you’re thinking, “This is super basic,” and you’re right! But sometimes, a basic immacualte grid is what you need, especially when you’re trying not to lose your mind. The key is to keep it simple, but not too simple. I mean, if it’s too simple, it won’t help you get anything done. Not really sure why this matters, but it just does.

And let me tell ya, when I first tried to implement my own immacualte grid, I was so pumped. I color-coded everything, made it all pretty, and then guess what? I forgot a whole column! Yup, just straight-up forgot to include the “due date” column. So, there I was, lost in my own colorful chaos, thinking, “What even is the point?”

Now, if you’re looking for practical insights, here’s a list of things you might wanna include in your own grid:

- Goals: What are you aiming to achieve?

- Deadlines: When does it all need to get done?

- Progress Tracking: How will you know when you’re done?

- Fun Stuff: Don’t forget to add things you enjoy!

And here’s the kicker—sometimes, the more you try to make your immacualte grid perfect, the more it just spirals into chaos. Like, maybe it’s just me, but I feel like the universe has a sense of humor when it comes to organization. You can plan all you want, but life just loves to throw in a surprise or two.

Let’s throw in a quick listing of potential pitfalls when dealing with the immacualte grid:

- Overcomplicating it: Seriously, don’t make it rocket science.

- Ignoring flexibility: Your grid should be able to adapt.

- Forgetting to review: Look at it regularly, or it’ll gather dust.

- Not making it fun: Who said grids gotta be boring?

In the end, the goal isn’t to have an immacualte grid that looks like it jumped out of a design magazine. Nah, it’s about finding a system that actually works for you. You want to be productive without pulling your hair out, right?

And if you’re sitting there thinking, “Ugh, I can’t even,” trust me, you’re not alone in this. We’re all just trying to figure it out, one messy grid at a time. So if your grid looks more like a Jackson Pollock painting than a neat spreadsheet, hey, that’s okay! Embrace the chaos. It’s all part of the journey.

So, in the grand scheme of things, maybe the immacualte grid is less about perfection and more about progress. Just keep tweaking it, and who knows? You might just stumble upon the perfect mix of order and chaos that works for you. Just don’t forget to laugh at the mess along the way!

From Clutter to Clarity: 5 Simple Steps to Create Your Own Immaculate Grid Today

So, let’s talk about this whole immacualte grid thing. It’s kinda like that perfect Pinterest board you see but can’t ever seem to recreate in real life. You know, the one where everything is color-coordinated and orderly? Yeah, not really sure why this matters, but I guess some folks think it’s a big deal.

First off, what even is an immacualte grid? In simple terms, it’s when everything is aligned just so, like a straight line of ducks in a row. But in the real world, things are more like a bunch of squirrels running around, right? So, if you’re trying to create an immacualte grid in your life, well, good luck with that! Here’s a quick table of what you might need to consider:

| Element | Description | Importance |

|---|---|---|

| Layout | How you arrange your stuff | It can make or break your vibe! |

| Color Schemes | Picking colors that go together | Adds flair, or so they say! |

| Spacing | The gaps between your objects | Too much or too little? Who knows! |

| Symmetry | Balance in arrangement | It’s visually pleasing, I guess! |

Now, you might think, “Okay, I get it, but how do I even start?” Maybe it’s just me, but I feel like the first step is to just throw everything on the floor and see what sticks. I mean, organizing can be a real pain. Who has time for that? But if you are serious about making an immacualte grid, here’s a few tips that could help:

Start Small: Pick one area. Maybe it’s your desk or a corner of your room. Don’t go all in like you’re training for the Olympics. Just take it easy.

Gather All Your Stuff: Get everything out of there. Papers, knick-knacks, you name it. It’s like a spring cleaning, but in fall or whatever season you feel like it.

Sort and Categorize: This is where it gets tricky. You gotta decide what you keep and what goes. Keep in mind, though, that sometimes things you think you need are just taking up space. Kinda like that sweater you haven’t worn since 2015.

Create Zones: Designate areas for different categories. Office stuff over here, craft supplies over there. It’s like zoning laws but for your belongings.

Maintain: Once you’ve got your immacualte grid, you gotta keep it up. Like, if you let the chaos creep back in, what was the point?

Now, if you’re looking for some practical insights, here’s a short listing of what to avoid when trying to achieve that elusive immacualte grid:

- Don’t overthink it: Perfection is overrated and, honestly, who’s perfect?

- Avoid clutter: If it doesn’t spark joy, throw it away. Or at least put it in a box for a year and see if you miss it.

- Don’t be afraid to change things up: If something isn’t working, switch it around. It’s okay, really.

I mean, let’s be real here. Life is messy. Even if you try to create an immacualte grid, things will still happen. Maybe your kids (if you got ‘em) will come in and mess it all up. Or your cat will decide that your perfectly arranged papers are now a bed. So, it’s not like you have to be a total control freak about it.

And speaking of messes, have you ever tried to make a digital immacualte grid? It’s like, you think you’re doing great, and then you look back and everything is just… off. Like a bad haircut. You can’t really fix it without starting over. But, just like in real life, sometimes you gotta embrace those imperfections and roll with it.

Here’s a handy little checklist for maintaining your immacualte grid:

- Regularly declutter—set a reminder, like once a month.

- Re-evaluate your zones. Are they still working for ya?

- Ask for help if you’re struggling. Friends love to give opinions, right?

- Take a break. Sometimes you just need to step back and breathe.

So, whether you’re going for that pristine immacualte grid or just trying to keep things from looking like a tornado hit, remember to keep it real. Life’s too short to stress over every little detail. Embrace the chaos, and maybe, just maybe,

Is Your Life in Disarray? Explore the Immaculate Grid Method for Instant Organization

In the world of design, the term immacualte grid often pops up like that one awkward friend who just won’t leave the party. It’s like, “Hey, I get it, you’re important, but could you chill for a sec?” Not really sure why this matters, but grids are one of those things that people obsess over in the design community. They say a good grid can make or break a layout, but honestly, it’s just a bunch of lines, right?

Alright, let’s dive into the nitty-gritty of what an immacualte grid is. It’s basically a system of horizontal and vertical lines that help keep everything organized. Think of it like a giant tic-tac-toe board, except instead of X’s and O’s, you’re placing images, text, and all sorts of fun stuff in a way that makes sense. It’s supposed to be all about balance and harmony, or some fancy words like that.

Now, here’s where it gets interesting — or maybe just confusing, depending on who you ask. You got your traditional grid, which is like your vanilla ice cream. It works, but it’s pretty basic. Then you’ve got your asymmetrical grids, which is like throwing sprinkles on that vanilla ice cream. It’s chaotic but in a fun way. I mean, who doesn’t love sprinkles, right?

If you’re new to this, you might be thinking, “What’s the big deal with an immacualte grid anyway?” Well, let’s break it down. A well-structured grid can help you create visually appealing layouts, making it easier for your audience to digest the information. Plus, it gives your design a professional look. Here’s a little table to help illustrate the differences:

| Type of Grid | Description | Pros | Cons |

|---|---|---|---|

| Traditional Grid | Equal spacing, symmetrical | Simple, easy to understand | Can be boring and predictable |

| Asymmetrical Grid | Unequal spacing, visual tension | Unique, eye-catching | Can be hard to balance |

| Modular Grid | Multiple columns and rows | Flexible, adaptable | Can become cluttered |

| Hierarchical Grid | Emphasizes importance through size | Directs focus | May confuse the viewer |

Now that we got that down, let’s talk about some practical tips for creating an immacualte grid. First off, you gotta choose your columns. This is like deciding how many slices of pizza you want — the more, the merrier, but too many can lead to chaos. A good rule of thumb is to stick with 12 columns for maximum flexibility. Yeah, I know, it sounds like a lot, but just trust me on this one.

Second, you should establish your margins. Margins are like the buffer zone, keeping your design from spilling over the edges like a toddler with a juice box. Too tight, and it feels cramped; too loose, and it looks like you’re just trying to fill space. Finding that sweet spot is key.

Moving on, you can’t forget about the gutters! No, not the ones outside your house that collect leaves. In design, gutters are the spaces between columns. They help separate your content, making it easier for the eyes to navigate. It’s like giving your viewer’s eyes a little breathing room.

Here’s a quick list of things to avoid when working on your immacualte grid:

- Don’t overcrowd your grid. Less is more, unless you’re talking about nachos.

- Avoid using too many fonts. Stick to two or three at most; otherwise, it’s a font party that no one wants to attend.

- Keep your color palette limited. Too many colors can make your design look like a clown threw up.

Maybe it’s just me, but I feel like the best designs come from a place of spontaneity. Sure, grids are great for structure, but sometimes you gotta throw caution to the wind and just wing it. It’s like cooking without a recipe; sometimes you get a masterpiece, and other times, well… you just order pizza.

In the end, the immacualte grid is a tool, not a rule. Use it to guide you, but don’t let it dictate your creativity. After all, if we wanted everything to be perfect, we’d all be robots. And who wants that? Embrace your imperfections, and you might just come up with something beautiful.

So, whether you’re a seasoned designer or a newbie just trying to figure it all out, remember — grids can help, but they don’t have to be your boss. Go wild, experiment, and see where your creativity takes you

Conclusion

In conclusion, the immaculate grid is a powerful design framework that emphasizes clarity, structure, and harmony in visual communication. By adhering to its principles, designers can create layouts that guide the viewer’s eye, enhance user experience, and convey information effectively. Throughout this article, we explored the key elements of the immaculate grid, including its historical significance, practical applications in various design fields, and its role in fostering creativity within constraints. As you embark on your design projects, consider implementing the immaculate grid as a foundational tool to elevate your work. Remember, a well-organized layout not only captivates your audience but also communicates your message with precision. Embrace the power of the immaculate grid and transform your designs into compelling visual narratives. Start experimenting today, and witness the difference it can make in your creative process!